You are Non-Fungible

To be perfectly honest, I feel bad about the barrage of NFT-related tweets and posts I’ve sent my friends and followers over the past three weeks or so. Having never been an early adopter of anything tech-related, I’ve rarely felt the impulse to either explain or shill opinions about the latest trends (I’m always a year or so behind). But something about NFTs (non-fungible tokens) has captured my interest. So much so that, for the first time, I broke away from my bubble of architecture and design, diving deep into art culture, cryptocurrency discourse, and various NFT platforms without knowing anything at the outset. The following is a brief report of my recent experiences.

Self-Value

My academic research interests can be summarized as: “the effects of digital culture on architecture and design.” While this might seem quite general, some of my recent investigations have included the intersection of video games and architecture, design software, social media and sponsored content, YouTube videos of construction advertisements, etc. You get the gist. Thus, when I discovered NFTs, they appeared as a natural evolution of this growing desire to come to terms with the virtuality of all of our media, including its politics and economics. Seen in this light, NFTs initially appeared to me as a way of attributing value to digital artworks (which is still largely the case). However, after researching them further and joining various online communities, it now appears that the value system that follows NFTs is in fact more about the self. A form of self-valuation more than anything else. Let me explain.

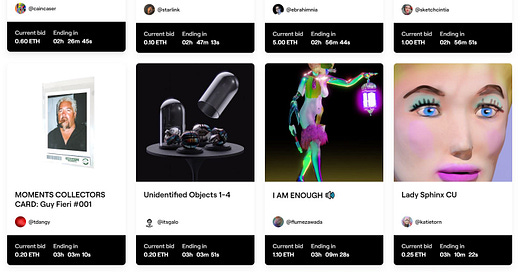

The current gold-rush frenzy happening with crypto art places an incredible amount of importance on hype and fame. Beeple, perhaps the most famous crypto artist to date, was an internet legend long before NFTs existed. The same could be said for many of the artists currently making huge profits on sites like SuperRare, Nifty Gateway and Foundation. In other words, the poster children for this gold-rush are established artists. It should also be noted that many of these artists have been freelancing for years, at times being exploited by big name brands who profit off their intellectual property and talent. According to someone from the team at Foundation, NFTs are significant because they allow artists to take control of their IP and be compensated fairly for their work and creativity. If companies would respect and pay freelancers well, would the NFT boom be as huge?

For the non-established artist, the one without hundreds of thousands of Twitter and Instagram followers, NFTs have promised a way out of the grind of commercial work (though corporations have recently entered the scene). And yet, the grind that comes with crypto art is the kind familiar to all emerging artists: self-promotion and networking. As hard as I thought finding clients for architectural projects was, it seems just as difficult to find a buyer for an artwork. The ratio of collectors to artists is heavily imbalanced. Moreover, the myth that the platform will make you as famous as Beeple is quickly debunked when you mint your first piece on the blockchain and it gets buried as quickly as it appeared. At times, your artwork is not even searchable. This is all to say that the phenomenon greatly benefits those who have been around the internet for a while, and have what we might call internet-clout (by way of memes, early net-art, or social media presence).

Still, in my quest for a Foundation invitation (as of today, one of the only ways to be able to publish work on the platform), I met an incredibly supportive community of artists on the platform’s Discord. Over the past month, we’ve gotten to know each other and have evolved into our own little hype team (mostly in the Lobby channel). In our short time there, many have moved onto become moderators on the channel, and have generously given away invitations to each other. It has been an incredibly wholesome experience. But it must be said, that what brought us together was the collective desire to participate in this economic arena, to add value to ourselves either as cash or clout. Discussions still often revolve around evaluating artworks or current Ethereum prices or minting fees (the cost to make an NFT and list it on the platform). It is a marketplace, after all.

Self-valuation is a huge component of the NFT community. It manifests itself as questions on how to price an artwork, worries of impostor syndrome, as well as supportive Tweets encouraging individuals not to feel bad that their work is not selling. The same digital consciousness that ties emotions to number of likes is at play here, only now money is involved for better or worse. It is important to reflect on the kinds of stress that come with this gold-rush.

Minting

I have been minting my work on three different platforms (Foundation, KnownOrigin, and Hic et Nunc) as of the beginning of March. The experiences vary, and I will not exactly be reviewing them here. As a quick overview, let me just say that Foundation has an excellent user interface, KnownOrigin has the most options for splitting profits, and making multiple editions, and Hic et Nunc is simply too much retro-fun. At the time of this writing, I have sold one piece on Foundation, none on KnownOrigin, and multiple small editions on Hic et Nunc as well as a major piece that I will discuss below. The minting process is perhaps the most cumbersome in all cases. Cryptocurrency requires a lot of layers of authentication and not every site is compatible with every wallet. Moreover, transferring and buying crypto is often painful as there are many transaction fees. Though there are other resources to learn more about minting NFTs, here I will just recommend that everyone take the transaction, gas, and withdrawal fees into consideration when pricing your virtual objects.

Being an outsider to the digital art community also impacted my approach to minting. In the beginning I thought of following the trends, and I repurposed some old projects, quite literally reanimating them into mintable animations. Later, however, I began to think more conceptually about what Non-Fungibility may have to offer the discipline of architecture. As a profession working primarily through PDFs, 3D models, JPGs, etc., I wondered how minting an architectural project might work. These questions led to the development of NFT House #1, a speculative residence designed primarily to be sold on the Tezos Blockchain (a proof-of-stake blockchain that uses significantly less energy than Ethereum).

NFT House #1 was completed over the course of a weekend. My partner and I agreed that we would limit the project to 12 billable hours, and since I would be doing most of the work, I used my current rate of $100/hr (this is quite low, but I am not the licensed architect in the office, and this is the lowest rate we offer). While we were not making a claim for this to be the best way to assert our value as designers, we felt that, as an experiment, it was fair to set the price at the lowest cost of labor we were comfortable with. The project was split into 3 components, the schematic design documentation (plans, sections, elevations), the original 3D model as a GLB file, and interior walkthrough perspectives rendered in a non-realistic way (so as to keep the project as energy efficient as possible). All files were minted on Hic et Nunc. On March 29, 2021, NFT House #1’s schematic design documents were sold on Hic et Nunc to an anonymous buyer with the Tezos address tz1ewLy4Z9CzzGxj4LovzrzXkeYUaaE8Xde5 for 100$XTZ (roughly $400).

Bubble

In a recent interview on CNN, Beeple mentioned that NFTs are pretty much a bubble. The kind of market speculation associated with this phenomenon does seem to look similar to an economic bubble. As someone far removed from economic speculation, all I can say is that to me it appears more like a cultural fad. Even the term “collectables” says much about the attitude surrounding NFTs. It recalls Pokemon cards or Pogs or Funko Pops. The underlying technology, however, may stay. That is to say NFTs as forms of authentication and verification of ownership have the potential to shift the way objects are attached to individuals. The decentralization of proof-of-stake cryptocurrency is also quite alluring to those of us weary of economic hierarchies.

As I have written previously, NFT art also comes with its own aesthetics. Currently it’s predominantly a mix of sci-fi surrealism, millennial pastels, software experiments, and digital mysticism/meta-jokes, amongst other things. And of course, memes. It’s tough to say whether those aesthetics will last, since cultural artifacts are always constantly evolving. The real lesson that I’ve learned from NFTs so far is that individuals are looking for alternative ways of both asserting their own value in an increasingly virtual world as well as building connections with others. Right now these are, for the most part, financially motivated, but they don’t necessarily have to be.